All you need to know about factoring without recourse

Factoring without recourse is a cash-flow management method that allows you to improve the performance indicators and to disperse risk of non-payments.

What is factoring without recourse?

Factoring without recourse is a form of financing where Aleja Finance, with financing on the basis of purchase of overdue or outstanding receivables, fully assumes the risk of non-payment by the debtor. Aleja Finance and debtor settle in case of non-payment their mutual issues within the context of insured receivables, without involving your company. Particular advantage of such type of financing is that receivables are completely eliminated from assets, which has a favourable impact on company credit rating and financial image.

To whom do we recommend factoring without recourse?

Companies who want to improve their financial image can use factoring without recourse as this completely eliminates receivables from the assets and increases cash flow. This does not increase the balance sheet base but the businesses performance indicators are improved. It is also used by companies that want to expand their business to foreign markets, because knowledge of foreign customer payment habits is of key importance for growth and successfulness on the foreign market.

How does factoring without recourse work?

Thanks to simplified procedure financing is in some cases possible within one day.

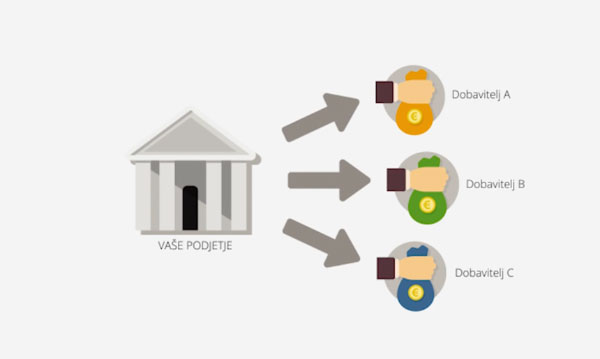

Company wants to eliminate receivable to Debtor from its assets and/or wants to transfer risk of non-payment entirely to Factor.

Aleja Finance receives invoice from Debtor and prepares Contract on factoring without recourse and Cession statement for Debtor.

Aleja Finance transfers the agreed amount of purchase to Company. With this money transfer receivables are eliminated from the assets.

Debtor transfers money to company Aleja Finance on agreed maturity date. In case of non-payment Aleja Finance and Debtor regulate the mutual issues in accordance with insured receivables.