All you need to know about purchase of receivables

Purchase of receivables allows you quick access to financial resources that are tied in overdue and outstanding receivables.

What is purchase of receivables?

Process of money circulation is completed only when payment is received for goods sold or services provided. Companies can offer their outstanding and overdue receivables in exchange for immediate payment to company Aleja Finance and thus shorten the time of money circulation. Through sell-out the companies may quickly transform their receivables into liquid monetary funds. In this way we provide you with higher working capital turn rate, bridging of current illiquidity and predictable cash flow.

To whom do we recommend purchase of receivables?

Purchase of receivables is recommended for companies that have an increased volume of receivables and want an effective solution for settling their receivables. Effective management of receivables is of key importance for successful business operation in every company. Companies do not need to wait as they can cede their receivable to customer at any time regardless of maturity.

How does purchase of receivables work?

We examine each receivable properly, check all financing possibilities and give advices at purchase itself and at receivables collecting.

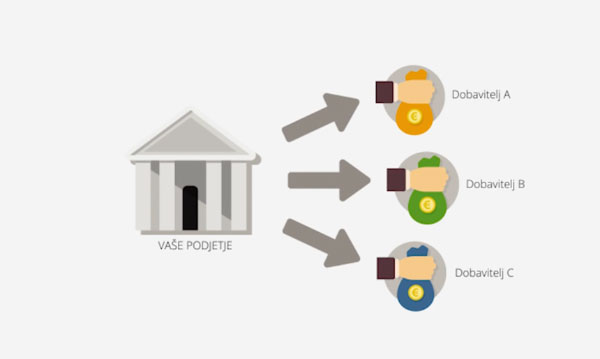

Company sells goods, material or performs services and issues an invoice to Debtor. The issued invoice is forwarded to company Aleja Finance.

Aleja Finance accepts invoice from Company and prepares Contract on purchase of receivables and Cession statement for Debtor.

Aleja Finance purchases receivable and immediately pays money to Company on the basis of ceded invoice.

At the maturity debtor transfers funds to company Aleja Finance and thus closes its obligation to new transferee of receivables.